TR Cutler, Inc. Market Research (TMR) just released the results of a survey conducted in the first two weeks of February, 2017. The respondents were all discrete manufacturers and all held VP or C-level titles. The universe of completed surveys totaled 401 and inquired about the highest priorities for manufacturers today. (The sample size ensures statistical significance to a probability of +/- 3%).

Key Findings and Frustrations

Unsurprisingly more than two-thirds (68%) of the participants said streamlining the supply chain is the highest priority for discrete manufacturing companies. Purchased parts are typically 60% or more of the manufacturing expense, driving tremendous pressure on materials and supply chain executives to trim costs, while simultaneously improving on-time delivery.

Interestingly a near identical percentage (67%) said that ERP (enterprise resource planning) solutions fall short of achieving accurate, real-time, visible supply chain data. This frustration is understandable as most medium and large manufacturing companies have already invested significant capital (both fiscal and human resources) in these ERP systems. ERP systems are capable of managing many business processes within the four walls of their operations, but fall short in providing complete supply chain visibility and collaboration capabilities.

Because of the prior investment into ERP, most senior manufacturing engineers, plant managers, VP of operations managers, and top supply chain executives, invariably look to their ERP/MRP vendors with whom they have been working for years, to solve the problem. Despite promises of ERP panaceas, none has an ideal solution for supply chain collaboration, supplier visibility, or the ability to access and aggregate voluminous amounts of real-time data from multiple sources.

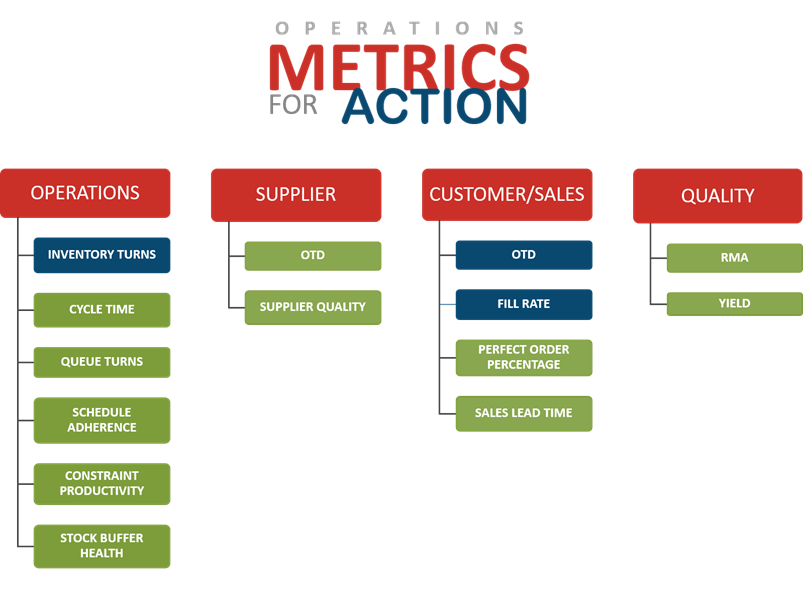

ERP systems are great for their intended purpose of managing and processing structured transactions. Manufacturing modules in ERP systems, however, do not have the flexibility to manage the real-time variability inherent in most manufacturing environments or the capabilities to support end-to-end production planning, scheduling and execution and associated visibility needs. Therefore, manufacturers who bought into the promise of holistic ERP solutions are forced to return to planning and scheduling using archaic spreadsheets. To address the market need for end-to-end supply chain visibility and collaboration, manufacturers need a solution that will connect to many data sources, such as logistics, supply chain management, lean production, inventory/warehouses, distribution, and transportation.

Synchrono solutions address these market needs. The company’s demand-driven solutions will work with any ERP system to capture transaction data; allowing manufacturers to maintain their current ERP investment and extend automated, end-to-end solutions to manufacturing operations and the extended supply chain. Synchrono has been facilitating collaboration between manufacturing plants and their global supply base in this way for nearly twenty years.

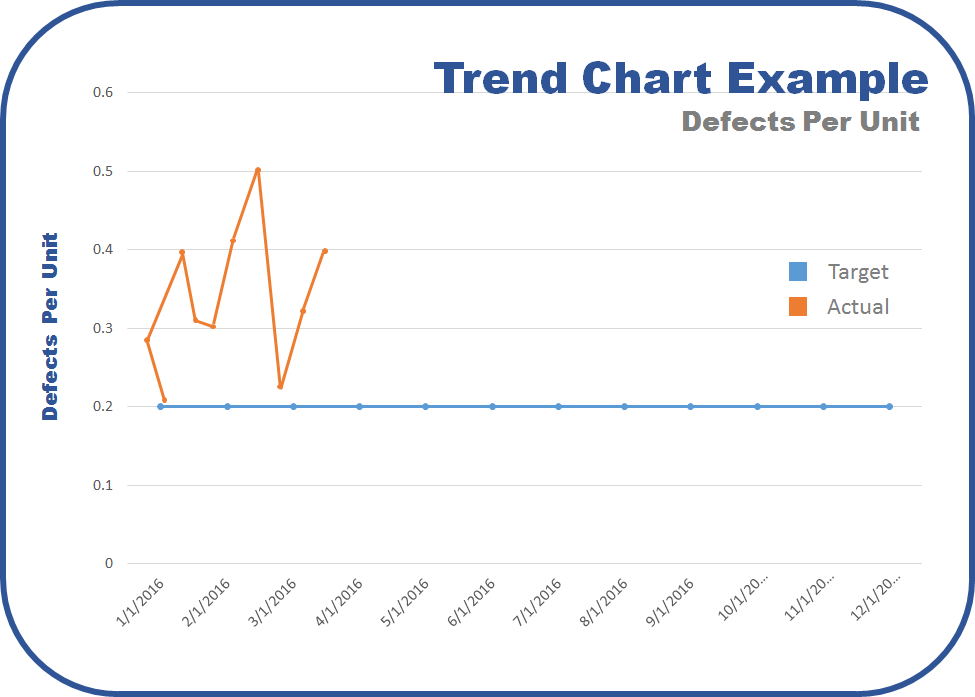

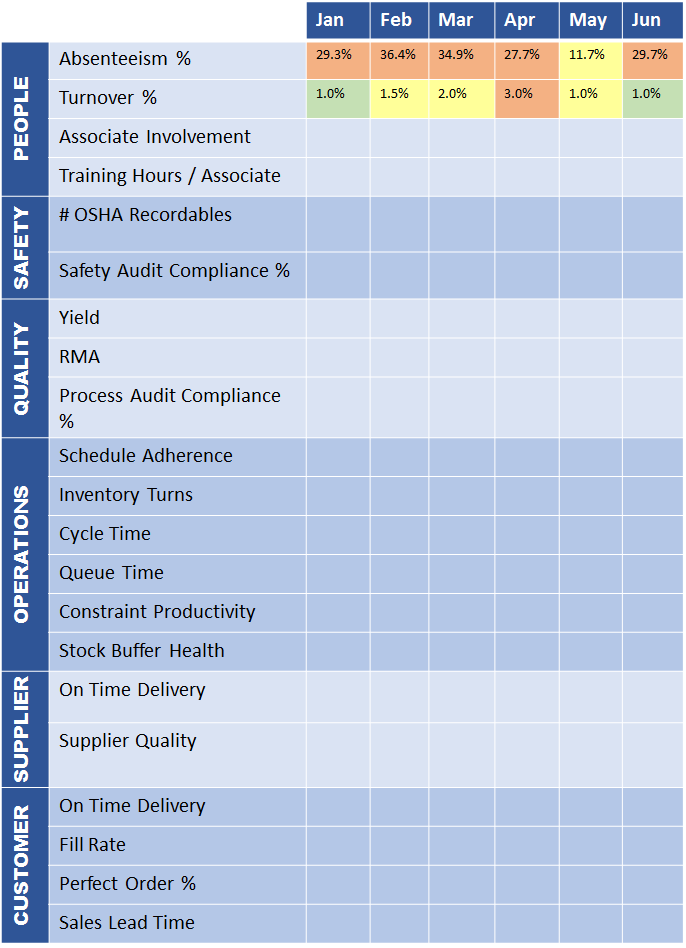

Synchrono data allows discrete manufacturers to gain visibility of demand and supply, simplify the buying and receiving processes, reduce inventory, eliminate part shortages, and track continuous improvement metrics. The ability to extend the value of the ERP system with secure, real-time supply chain visibility solutions gives both IT and the business, the tools to be successful.